Massive property valuation, AVM

Our Massive property Valuation use a geotatistical methodology service

The mass valuation service provided by real estatesEuroval uses a geostatistical methodology, offering a current valuation of the real estatesclient’s real estate portfolio and the characterization of each real estateand the portfolio as a whole.

It is carried out with a standardized methodology of statistical evaluations according to the following automated process (desktop evaluation):

– Geographical location of the real estateby geographical coordinates

– Qualification of the real estatein order to determine its real estatescomparables

– Identification of the homogeneous geographical area or local market to which it belongs

– Standardized statistical calculation of the value of real estateand the reliability of the estimate

– Review of value results by professional experts

Frequently Asked Questions

What are the purposes of the AVM?

Fundamentally for application in the massive valuation of portfolios ofreal estates, in the diverse cases of:

- Purchase and sale

- Rating

- Due-diligence (value and portfolio quality)

- Management

- Segmentation

- Study

- Risk

- Management real estates

- Compliance with CBE 3/2008 and 3/2010

- Assurance

- Rating

- Under-insurance detection

What assets real estatesare susceptible to AVM?

| Residential | Commercial |

| Dwelling in buildings | Offices |

| Dwelling single-family house (terraced, semi-detached and isolated) | Multi-purpose premises |

| Garages / storage rooms | Garages / storage rooms |

How does Euroval carry out the AVM service?

Based on a minimum of information provided by the client, the service provides each real estate:

- Standardization with the Cadastre

- Market value

- Forced sale value

- Market situation in the area

- Recall

The AVM service, consists of an experienced assessment carried out in an automated way equipped with:

- Specific methodology for rural areas

- Review by technical appraisal team

With AVM, an application is provided to manage the results obtained:

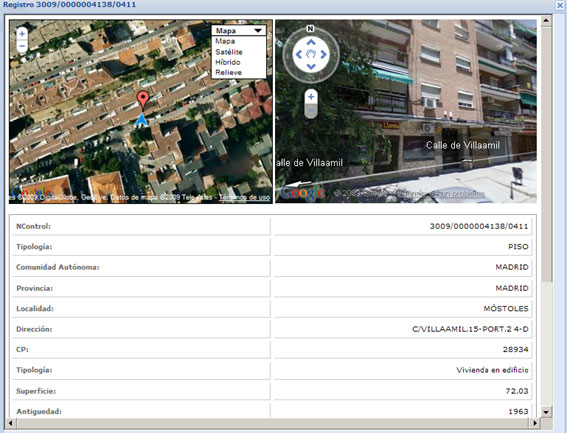

- Geo-location

- Aggregated information by zone

- Characterization

- Zone and street view

Why is this type of assessment necessary?

- So that the decision to buy or sell a portfolireal estateso is truly informed.

- To segment or plan the portfolio management real estateswith complete individual information of each real estate.

- For the updating of securities real estatesas collateral for EEFF’s mortgage portfolios required by Bank of Spain regulations.

Why Euroval?

Euroval is always governed by the principles of rigour, independence and objectivity. Rigor is ensured by the strict valuation rules to which we are subject, which establish the methodology and valuation criteria most appropriate to the purpose of the report. Independence is safeguarded by the composition of the company’s shareholders, administrative body and experts, who are not linked to any person, company or entity that may generate a conflict of interest with the assets to be evaluated or expert witnessed. We are solely and exclusively dedicated to valuation, both in Spain and in other countries, acting in accordance with the regulations established in this respect and monitored by the system of supervision to which the company is subject, which guarantees its objectivity.

For all the above reasons, we offer you the preparation of this type of report with a methodology in accordance with the nature of the asset and the purpose of the report, and, where appropriate, in accordance with the requirements of the regulations in force. Euroval is a company approved by the Bank of Spain and by the CNMV (Spanish National Securities Market Commission). Our reports appraisal have a total guarantee of objectivity.

Ask us for a free quote

See an Example

of our Reports for Valuation AVM.

Company approved by the Bank of Spain and by the National Securities Market Commission, CNMV.